Like input and input services, businesses acquire capital goods in the ordinary course of business that is intended to be used for business or personal purposes OR is taxable or exempt. Credit for capital goods related to the business and its activities is permitted based on the useful life of that particular capital good, with the remaining unavailable ITC reversed.

The primary intention of credit apportionment concerning capital goods is similar to that of Rule 42, i.e. input and input services. The steps to apportioning the input tax credit are as follows.

Step 1: Determine Common Credit

This step is a bit complex and requires clear bifurcation of every source of ITC included in the total ITC, and the unnecessary ones will be deducted to reach the common credit amount.

- ITC on non-business/exempt supplies

These credits are primarily not allowed to be availed by the registered person. Thus, these credits are not added to E. Credit Leger and are added to the output tax liability right away.

- ITC on taxable/zero-rated supplies

Such entries are entirely for taxable supplies, which include zero-rated supplies. Such credits are eligible and are added to the E. Credit Ledger. There is no confusion as it is for business purposes. - Capital Goods Used for Both Purposes

The tricky part is that capital goods used partially for business and partially for non-business purposes must be separated, and the eligible ITC must be added to the E. Credit Ledger, while the ineligible part must be added back to the out-tax liability. There are situations in which credit relating to capital goods is handled differently like:

- Capital Goods that were ALWAYS used for both purposes (C1)

As the situation indicates, capital goods were always used for business and non-business purposes, so they have the case of Common credit or Mixed credit, which must be separated.

For example, the director’s car has been used for business and personal purposes since it was purchased.

- Capital Goods were First used only for non-business/exempt supplies and subsequently used for Common use (C2)

In this case, capital goods were first used for non-business purposes. Credit relating to them was not available for claiming during a specific period in their useful life. After a point, the goods were used for common use, making the credit partially available for availing.

For example, the director’s car was previously used by his wife, and the director later began using it for business meetings as well (common use)

To tackle such a situation, a set of normal steps should be taken

Step 1) Add the entire ITC to the E. Credit Ledger

Step 2) Eliminate the portion of ITC which was exclusively used for non-business/exempt supplies

According to the rules, obtaining the common credit in such a case, 5 % of each quarter or part thereof from the date of purchase until the date it was put to common use should be added back to the output tax liability. This will, in turn, leave the remaining amount to be the common credit.

- Capital Goods were First used only for Business/taxable supplies and subsequently used for Common use (C3)

In this particular situation, capital goods were first used exclusively for business/taxable supplies and were subsequently put to common use. It is clear that the ITC calculation, reconciliation and claim were going as per the normal course until such a capital good was put to common use.

For example, the director’s car was originally only used to chauffeur him to business meetings, but in his spare time, his wife began using it for leisure.

To deal with such a situation, it is evident that the date when the capital goods were put to common use was when common credit entered the picture; thus, the remaining credit will be considered common credit and added to the E. Credit Ledger.

Step 2: Common credit during the useful life

Now that we’ve determined the amount of common credit (with varying remaining useful life), we’ll divide it by the number of months of the useful life of the capital goods.

NOTE: the useful life of capital goods in the Act has been fixed to be 60 months/5years.

Common Credit per month = C1+C2+C3/60 months

Step 3: Apportionment of Exempt/non-taxable credit from the common credit

The aggregate value of exempt supply for a month/Total Turnover in the state for month x Common Credit per month

This amount will lead to the total amount of exempt supply credit out of the common credit, which can be added back to the output tax liability.

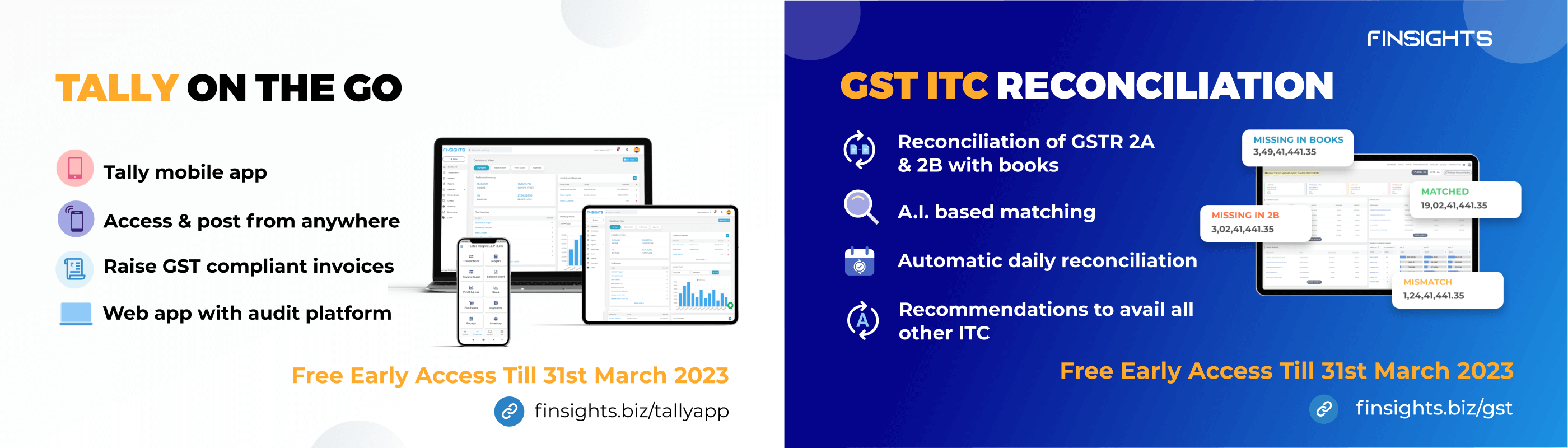

According to Rule 43, a registered person should apportion the credit for capital goods used for business and non-business purposes. To avoid this complex calculation process and any intentional/unintentional errors, Finsights, an automated mechanism that allows for faster ITC reconciliation, should be used.

These calculations add up to a complete picture of accurate ITC reconciliation. Finsights handles all other back-end operations, such as labelling each entry with a specific status label, to help the user understand and quickly complete the reconciliation process.